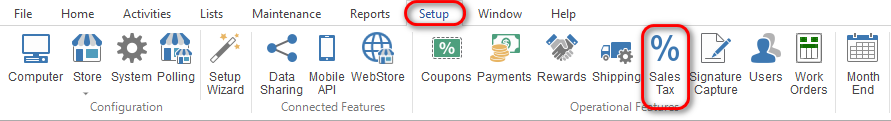

Whether you are wanting to set up alternates sales tax rates for an upcoming Tax-Free weekend, or simply need them to separate state, city, and county taxes, the sales tax feature takes moments to set up. To set up a new alternate sales tax rate, go to:

-

Setup > Alternate Sales Tax List

-

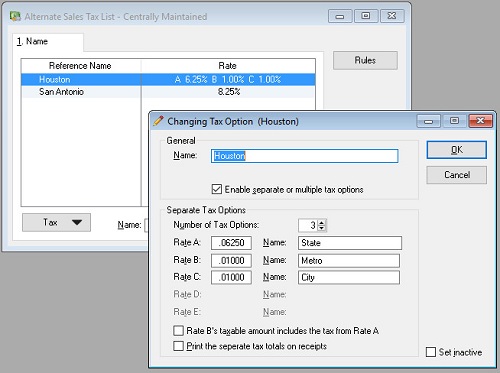

Select the Tax button located in the bottom left-hand corner and choose New Tax Option or Edit Tax Option depending on what you want to do.

-

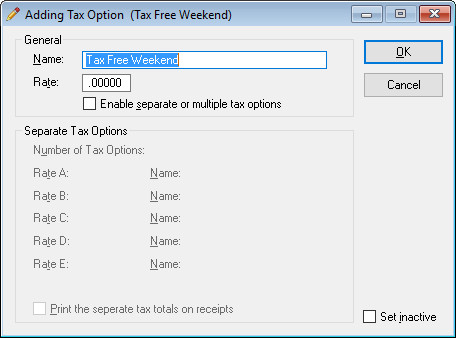

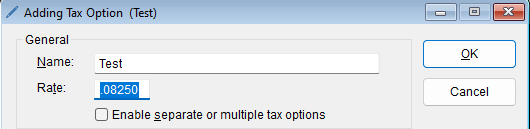

Name the tax option in the Name field.

-

Next, if the tax option is a single rate, then type that in the Ratefield.

-

Remember: the tax rate is in percentages. So if the tax rate is 8.25%, then you’ll need to enter “.0825” in the Ratefield.

-

If the tax option needs to include multiple tax options, check the box entitled, Enable separate or multiple tax options.

-

Use the up and down arrows next to Number of Tax Options to select the desired amount of tax options.

-

In each Rate field, enter the tax rate.

-

In each Name field, enter the name of each rate.

-

At the bottom of the active window there are a couple of options on how the separate tax options will be displayed and calculated.

-

Once all of the desired preferences have been set, select OK to save and add the newly created tax to your list of active sales tax options.

-

-

-

-

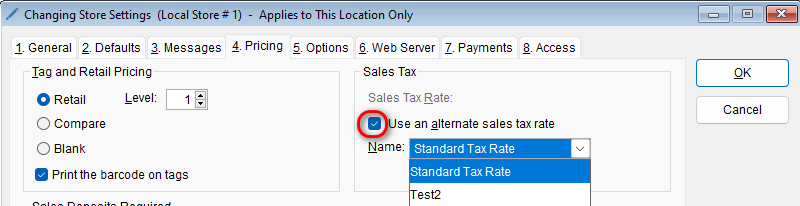

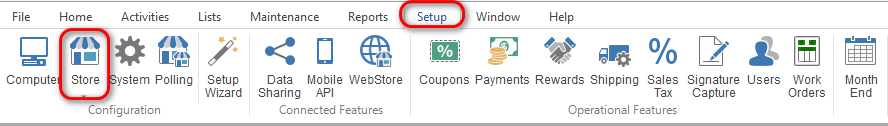

- To check on your Sales Tax settings by store go to Setup > Store

- Open your store in question and click on the 4. Pricing tab

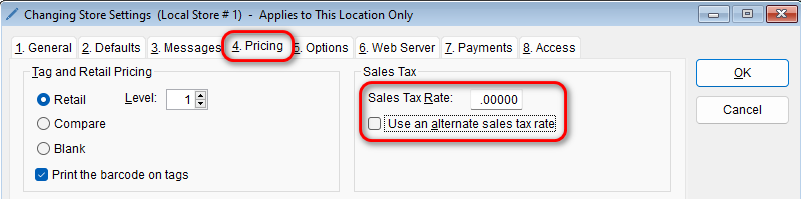

- Here you can set the sales tax rate as a static value, or select one of the tax rates you have created prior by selecting the Use an alternate sales tax rate check box

- Here you can set the sales tax rate as a static value, or select one of the tax rates you have created prior by selecting the Use an alternate sales tax rate check box

- Open your store in question and click on the 4. Pricing tab

- Make sure you set the needed value for each of your stores as needed